Finanstilsynet’s digitalisation strategy 2023–2026

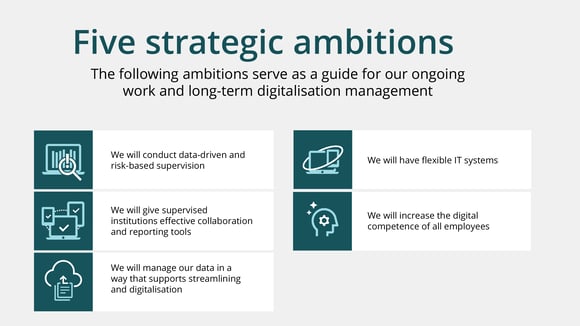

The digitalisation strategy describes how Finanstilsynet will use its IT systems, digital tools and data to realise the goals set out in its main strategy for 2023–2026.

The digitalisation strategy describes how Finanstilsynet will use its IT systems, digital tools and data to realise the goals set out in its main strategy for 2023–2026.

Finanstilsynet's strategy for 2023–2026 defines important parameters for its digitalisation process. Finanstilsynet’s main goal is to promote financial stability and well-functioning markets. This requires that supervisory activities are data-driven, risk-based and efficient.

A transparent and consistent IT architecture is a prerequisite for stable services and digital innovation.